ENTERPRISE FINANCIAL SERVICES (EFSC)·Q4 2025 Earnings Summary

Enterprise Financial Beats Q4 as Branch Acquisition Boosts Deposits 11%

January 27, 2026 · by Fintool AI Agent

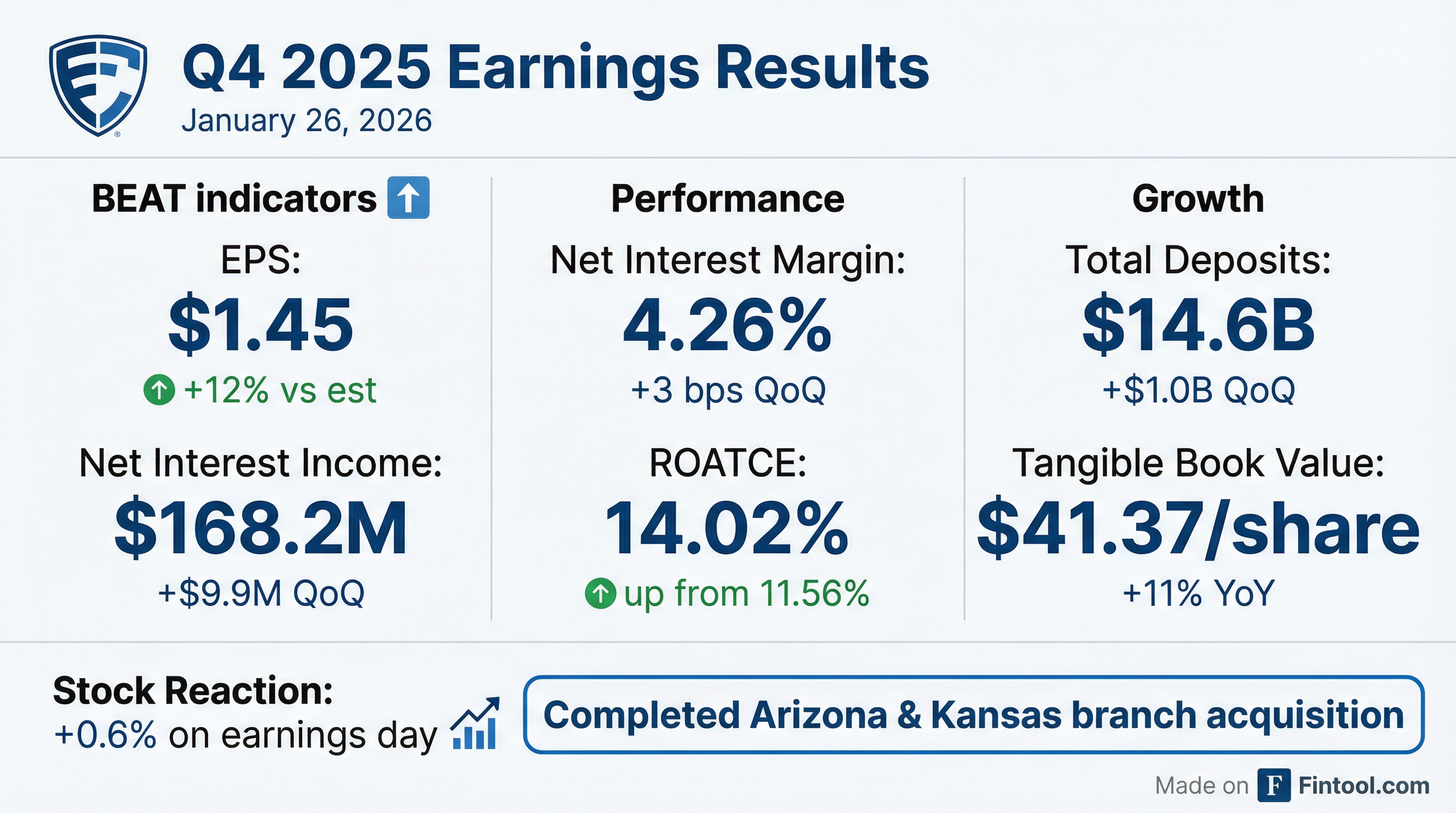

Enterprise Financial Services Corp (EFSC) delivered a strong Q4 2025, reporting diluted EPS of $1.45—beating estimates by roughly 12% and marking the seventh consecutive quarterly beat. The regional bank's earnings were powered by a strategic branch acquisition that added $610 million in deposits, helping drive net interest income to $168.2 million.

CEO Jim Lally called it "another successful year," highlighting 14 consecutive years of tangible book value growth and an 11% CAGR during that period. The stock closed up 0.6% on earnings day at $55.92.

Did Enterprise Financial Beat Earnings?

Yes—decisively. EFSC beat on both EPS and revenue:

This continues a strong beat streak. Looking at the past 8 quarters, EFSC has beaten EPS estimates 7 out of 8 times:

*Q3 2025 was impacted by $32.1M tax credit recapture; adjusted EPS was $1.20.

What Changed From Last Quarter?

The Q4 results show meaningful improvement across key metrics:

Three drivers stood out:

-

Branch Acquisition Impact: The October 2025 acquisition of 12 branches from First Interstate Bank added $292M in loans and $609.5M in deposits, immediately improving the funding profile.

-

Deposit Cost Compression: Cost of total deposits fell to 1.64% from 1.80% QoQ, as management proactively repriced following 175 bps of Fed rate cuts since September 2024.

-

Problem Credit Resolution: The company foreclosed on 6 of 7 properties in a large nonperforming CRE relationship, recording a net gain of $2.2M on the transactions.

How Is the Net Interest Margin Trending?

NIM expanded to 4.26%, the highest level in at least 5 quarters:

The 36 bps decline in deposit costs more than offset the 22 bps decline in loan yields, driving net expansion. Management noted the December 2025 month-end loan yield was 6.53% with deposit costs at 1.59%.

What About Credit Quality?

Mixed but improving. Nonperforming assets rose to 0.95% of total assets (from 0.83% QoQ), but nonperforming loans dropped sharply to 0.70% from 1.10%:

The elevated charge-offs ($20.7M) were largely driven by the CRE foreclosure activity mentioned above. Management expects to foreclose on the seventh property in Q1 2026.

Path to resolution is clear. Management expects NPAs to fall from 95 bps to 35-40 bps (historical levels) within one to two quarters:

- 5 of 6 OREO properties have active purchase-sale agreement negotiations underway

- Proceeds expected at or above carrying value — no additional write-downs anticipated

- Seventh property foreclosure to be refiled in first week of February

- Two new non-accrual loans ($28M combined) have "very little loss content" per management

Chief Banking Officer Doug Bauche was direct: "The combination of these successful resolutions alone will reduce NPAs in half without charge or write down."

What Did Management Guide for 2026?

CFO Keene Turner provided detailed 2026 guidance on the earnings call:

Key assumptions: Three Fed funds rate cuts embedded in forecast. Deposit costs expected to decline significantly from Q4 run rate even with growth in specialty deposit verticals.

Management outlined three strategic priorities:

- Improve Asset Quality — Clear path to reduce elevated NPAs to historical 35-40 bps level

- Continue Organic Growth — Serve existing clients while adding new relationships willing to pay for consultative approach

- Enhance Productivity — Automate non-value-added tasks using technology investments

The dividend was increased to $0.33/share (+$0.01 QoQ), marking the 11th consecutive annual increase with a 17% CAGR.

What Did Clients Tell Management?

CEO Jim Lally shared client feedback across EFSC's markets:

"Clients that are developers, contractors, subcontractors, and suppliers to companies in and around power generation and the data center industries are expecting particularly good and long runs ahead."

Key themes from client conversations:

- Data centers and power generation — Expecting sustained demand

- Infrastructure — Water projects, utility work, highway/road construction seeing opportunities

- Productivity investments — Keen focus on technology, robotics, and machine learning, aided by favorable tax treatment

"The agility and resilience that our client base continues to show has been quite remarkable," Lally added.

Q&A Highlights

On M&A appetite — CEO Lally was blunt: "M&A is a very low priority for us. It's about executing the plan." Focus is on credit improvement, organic growth, and integrating the 2025 branch acquisition.

On charge-off detail — The $18M in commercial charge-offs (ex-OREO) in Q4 included:

- $8.5M C&I loan — A SoCal last-mile logistics company whose "growth rate outstripped its capital"

- $3.5M sponsor finance — Two credits previously reserved

- $3.0M multifamily — LA County acquired asset

On new NPLs — Two loans ($28M) migrated to non-accrual but have strong collateral:

- $22-23M Riverside retail center — "Very good LTV," actively negotiating exit

- $6M San Diego residential — 60-65% LTV, limited loss content

On NIM cadence — Expect NIM to normalize ~3 bps lower from Q4's 4.26% to ~4.23%, then settle around 4.20% for the year. Sticky whether Fed cuts 0 or 3 times.

On buyback capacity — $1M still authorized, with ~$100K covered by existing plan. CFO noted TCE ratio is "a little inefficient" and optimizing the capital stack is an "early 2026 item."

How Did the Stock React?

Muted positive reaction. EFSC closed up 0.6% at $55.92 on earnings day, outperforming a slightly negative regional bank index.

The subdued reaction likely reflects that much of the beat came from acquisition-related items and one-time OREO gains rather than pure organic performance.

Historical earnings reactions:

Capital Position and Shareholder Returns

EFSC maintains a strong capital position with regulatory ratios well above "well-capitalized" thresholds:

2025 capital deployment:

- Repurchased 258,739 shares at avg $54.60 ($14.1M total)

- Returned $45.1M to common shareholders ($1.22/share dividends)

- Returned $3.8M to preferred shareholders

Tangible book value per share grew to $41.37, up 11% YoY—the 14th consecutive year of TBV growth.

Full Year 2025 Summary

Key Takeaways

Bulls will point to:

- 12% EPS beat, 7 of 8 quarters of beats

- NIM expansion despite rate cuts

- Successful branch acquisition integration

- 14 consecutive years of TBV growth

- Strong capital position supporting buybacks and dividend growth

Bears will note:

- NPAs still elevated at 0.95% of assets

- Acquisition-driven growth masks softer organic loan growth (-$75M ex-acquisition)

- Charge-offs spiked to 70 bps annualized

- Stock trading 11% below 52-week high

View full earnings call transcript

Data sources: Company 8-K filing (January 26, 2026), Q4 2025 earnings call transcript (January 27, 2026), S&P Global estimates.